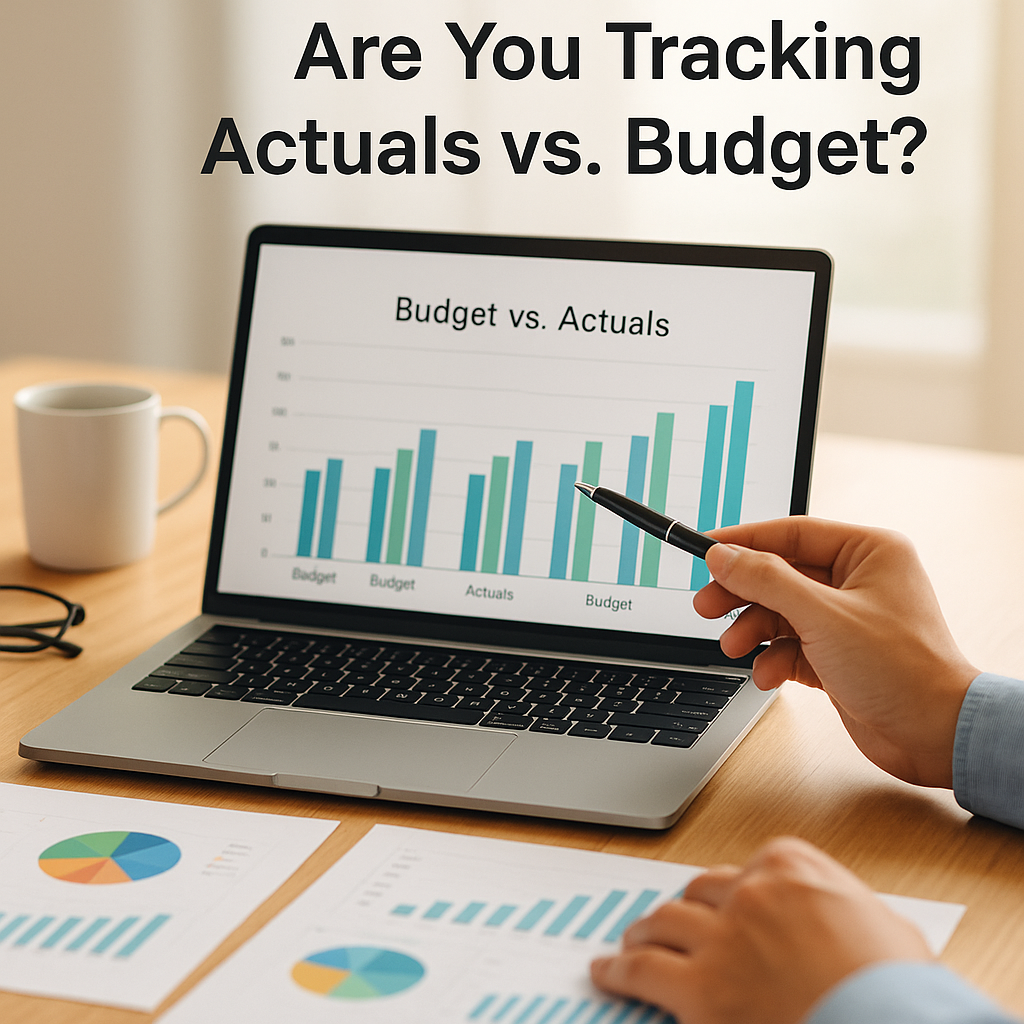

Are You Tracking Actuals vs. Budget Regularly? Here’s Why It Matters More Than You Think

A few years ago, I worked with a business owner who proudly showed me the beautiful budget he’d built at the start of the year. Every line item was perfect. Revenue targets, marketing costs, even the coffee budget—it was all there.

But when I asked him how often he checked his actual results against that budget, he paused.

“Um… I look at it every December… to see how far off I was.”

He laughed, but there was some embarrassment in his voice.

And he’s not alone.

The Budget That Sits in a Drawer

Here’s the thing: your budget isn’t a once-a-year exercise.

It’s meant to be your guide throughout the year, helping you answer questions like:

- Are we making enough money to hire that new person?

- Are expenses creeping higher than we planned?

- Are we on track for our goals—or way off course?

If you don’t compare your actual results to your budget regularly, you’re flying blind.

Why You Should Check Actuals vs. Budget

Here’s why this simple habit makes such a huge difference:

1. Catch Problems Early

Let’s say your sales drop for two months in a row. If you’re watching your numbers, you’ll notice the trend and can investigate right away.

But if you wait until year-end? You’ve lost valuable time—and possibly a lot of money.

2. Make Smart Decisions

Thinking about expanding your office? Hiring another salesperson?

When you’re tracking actuals vs. budget, you’ll know whether those decisions are affordable—not just hope they are.

3. Gain Credibility

Whether it’s investors, lenders, or even your team, people trust leaders who know their numbers. Regularly checking your actuals builds that confidence.

4. Learn and Improve

Budgets aren’t always perfect—and that’s okay.

When you look back and compare your plan to reality, you’ll discover where you were too optimistic (or too cautious) and improve your forecasts for next time.

How Often Should You Check?

If you’re wondering how often to review actuals vs. budget, here’s my take:

✅ Monthly is a must.

✅ Weekly or biweekly if you’re growing fast or have tight cash flow.

Key things to check:

- Sales vs. goal

- Expenses (especially variable ones like marketing)

- Gross margin

- Net profit

- Cash on hand

Tools That Make It Easier

The good news? You don’t have to live in spreadsheets.

Some of my favorite tools include:

- QuickBooks – Great for small businesses.

- Xero – Super user-friendly.

- Jirav or Planful – Perfect for deeper forecasting and dashboards.

This is Where a Virtual CFO Comes In

If this sounds overwhelming, you’re not alone.

A good Virtual CFO can:

- Set up reports that show you exactly where you stand

- Help you understand what the numbers mean

- Give you guidance on what actions to take next

Basically, they turn your budget from a dusty file into a real tool for running your business.

Final Thought

So… Are you tracking actuals vs. budget regularly?

If not, there’s no better time to start than right now. It doesn’t have to be complicated—but it can completely change how you run your business.

Because at the end of the day, the numbers tell your story. And it’s a story you want to be in charge of.

Curious how a Virtual CFO can help you make sense of your numbers? Let’s chat.