Cash Flow Impacts of Changing Payment Processors: A Practical Guide for Healthcare Finance Leaders

Switching payment processors can feel like swapping the engine on a moving car. You know it’s necessary, but you also know a misstep can stall cash flow, frustrate patients, and create extra work for your team.

Summary: Change processors only with a cash-flow-first plan: quantify timing impacts, validate reconciliation and reporting, stage the cutover, and monitor the first 90 days. Do this and you keep collections steady, reduce surprise write-offs, and maintain confidence with providers and leadership.

What’s the real problem?

Healthcare organizations are balancing tight margins, complex payer mixes, and high patient-expectation for seamless payments. A payment processor change is technical, but its biggest consequences show up in cash flow and operations.

- Unclear timing of settlement windows creates unexpected float gaps between pay-ins and bank deposits.

- Reconciliation mismatches increase manual work and delay month-end close.

- Billing front-desk and patient portals behave differently, driving higher call volume and lost collections.

- Leadership sees volatility in AR aging and questions the FP&A forecast accuracy.

What leaders get wrong

Leaders often treat processor change as an IT or procurement project. That misses the finance and operational realities:

- Underestimating timing differences—assuming new processor settlements match the old one-to-one.

- Skipping end-to-end recon tests and assuming reporting fields map perfectly.

- Not aligning front-line staff training to changes in patient payment flows, leading to avoidable declines or refunds.

- Not building contingent cash reserves for the first 4–6 weeks post-switch.

A better approach

Treat a processor change as a finance-led project with strong ops and IT partnership. Keep the focus on cash availability, reconciliation fidelity, and patient experience.

Follow this 4-step framework:

- Discover and map: Document current settlement timing, fees, chargeback flows, reporting exports, and downstream systems (EHR, billing, general ledger).

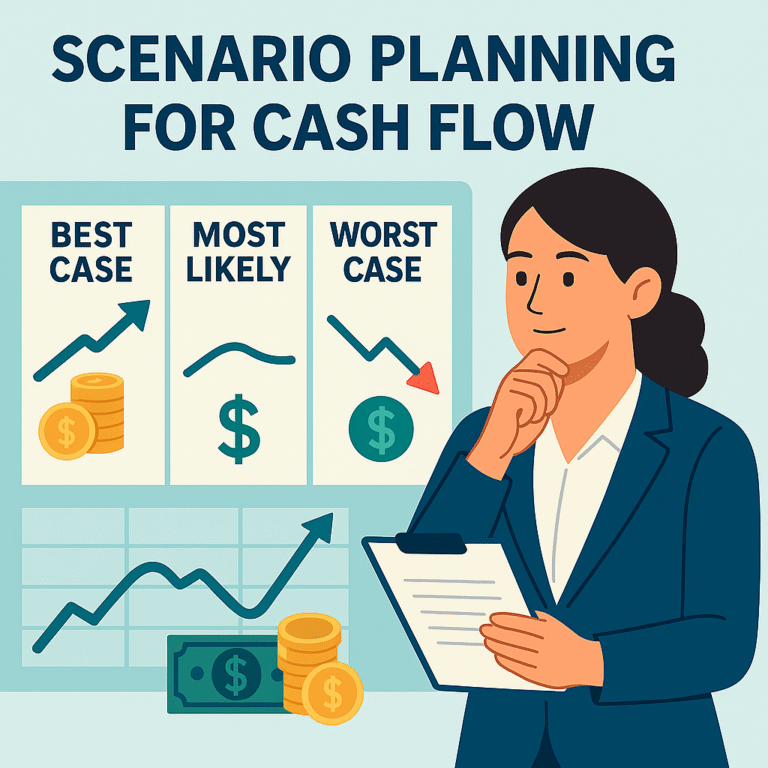

- Model cash impact: Build a 90-day cash-flow model comparing current vs. new processor timing, including worst-case settlement delays and reserve requirements.

- Pilot and reconcile: Run side-by-side processing for a representative slice (one clinic, one payment type), validate settlement files, and reconcile to bank deposits daily.

- Cutover and monitor: Staged migration with daily dashboards for the first 30 days, weekly for 60–90 days, plus a rapid response team for issues.

Real-world note: A regional health system we worked with modeled a 10-day shift in settlements and held a modest reserve equal to one week of card receipts. That reserve covered a timing gap and avoided a credit line draw—saving them 1.2% in interest expense over three months.

Quick implementation checklist

- Document current settlement cadence, fees, and reporting fields.

- Build a 90-day cash-flow sensitivity (best, expected, worst cases).

- Run a 2–4 week side-by-side pilot on a small revenue stream.

- Map and test automated reconciliation between processor, bank, and GL.

- Train billing staff and patient-facing teams with scripts for new decline/refund flows.

- Establish a temporary reserve equal to 7–14 days of average card receipts.

- Create daily dashboards for deposit timing, chargebacks, and refunds in the first 30 days.

- Define escalation paths and an incident-response owner in finance.

- Communicate with key payers and large employer accounts about the change and possible short-term reporting differences.

What success looks like

- Reconciliation accuracy: 99% match between processor settlements and bank deposits by day 14 post-cutover.

- AR days stable or improved: no more than a 1–2 day temporary increase in DSO during transition.

- Operational efficiency: month-end close impact reduced to under 2 extra hours per issuer team member.

- Patient collections: net patient collections within 0–1% variance of forecast during the first 90 days.

- ROI: net savings from lower processing fees and reduced disputes payback within 12–18 months.

Risks & how to manage them

-

Risk: Settlement timing mismatch causing temporary cash shortfall.

Mitigation: Hold a 7–14 day cash reserve and align treasury with expected settlement windows. -

Risk: Reconciliation gaps and data mapping errors leading to write-offs.

Mitigation: End-to-end test files, daily reconciliation during pilot, and automated exception reporting. -

Risk: Patient experience degradation (declines, portal issues) harming revenue and satisfaction.

Mitigation: Train front-line staff, update patient communications, and monitor chargeback/refund trends daily.

Tools & data

Use finance automation to remove manual reconciliation—modern tools can ingest processor settlement files, match deposits to transactions, and surface exceptions automatically. Power BI or similar visualization tools let you build daily operational dashboards that leadership actually reads.

Set up three essential reports: a daily deposit vs. settlement reconciliation, a rolling 90-day cash-flow sensitivity, and a leadership scorecard showing AR days, net collections variance, and dispute trends. Make sure these reports tie back into your FP&A forecast and leadership reporting so decisions are data-driven.

Next steps

If you’re considering a processor change, start by running the 90-day cash model and scheduling a 2–4 week pilot. Bring finance to the center of the project—before procurement or IT finalize the switch.

We help healthcare finance leaders plan and execute processor migrations with minimal cash disruption. If you’d like, we can review your current settlement cadence and build a focused 90-day impact model to share with your CFO and operations leads.

Work with Finstory. If you want this done right—tailored to your operations—we’ll map the process, stand up the dashboards, and train your team. Let’s talk about your goals.

📞 Ready to take the next step?

Book a 20-min call with our experts and see how we can help your team move faster.

Prefer email or phone? Write to info@finstory.net

or call +91 44-45811170.