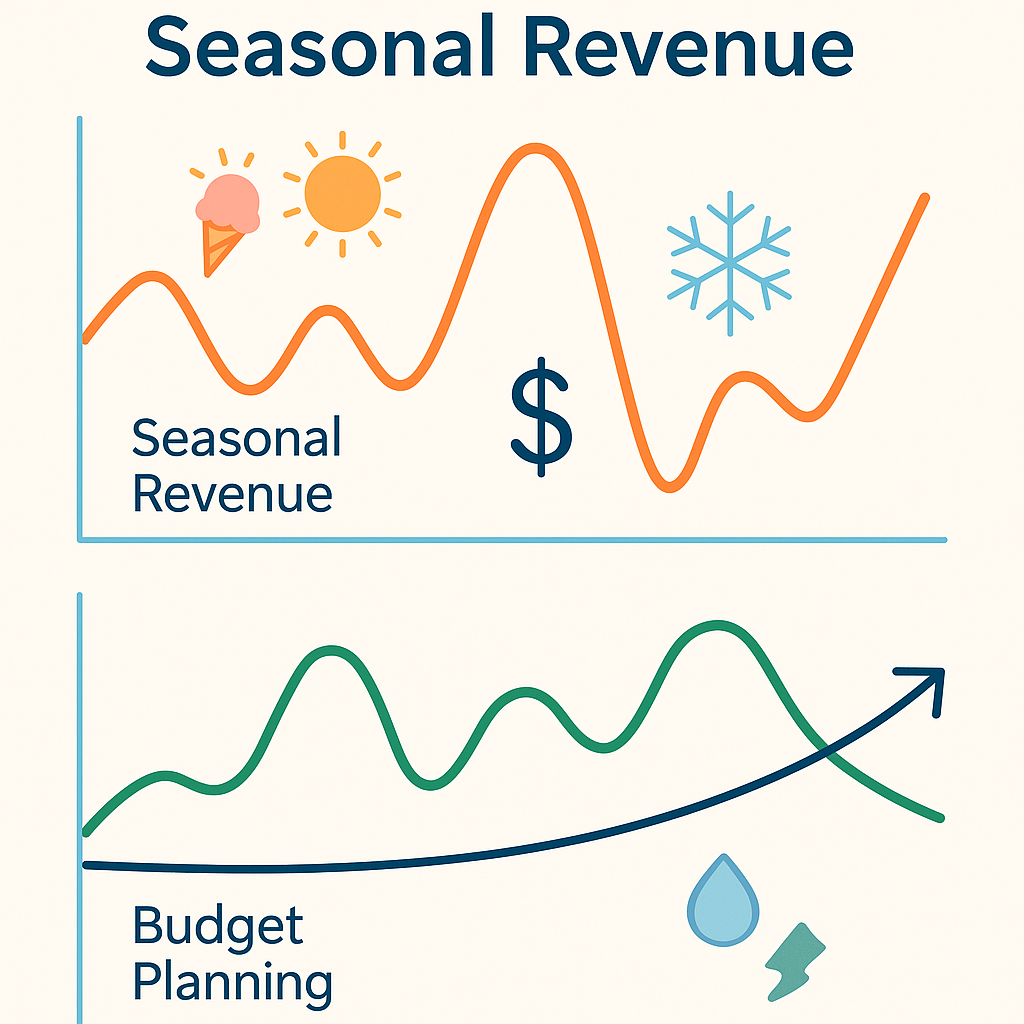

Creating a Budget When You Have Seasonal Revenue Swings

Let’s be honest—creating a budget is challenging enough. But when your revenue soars during certain months and slumps in others, budgeting can feel like trying to ride a rollercoaster blindfolded.

If your business has seasonal ups and downs, you’re not alone. Retailers see holiday spikes. Event planners boom in wedding season. Even service businesses can have busy and quiet months.

The good news? You can absolutely build a budget that handles seasonal swings—and keeps your cash flow healthy all year.

Why Seasonal Businesses Struggle With Budgeting

Let’s look at two real-world examples:

Example 1: The Ice Cream Shop

Raj owns an ice cream shop in Chennai.

- From March to June, he can’t scoop fast enough.

- But come November, sales drop as the weather cools.

In past years, he’d budget the same monthly revenue all year. Result?

- Summer profits vanished trying to cover winter losses.

- Staff layoffs and cash flow panic in slow months.

Example 2: A Wedding Photographer

Ananya, a wedding photographer, makes 80% of her income between October and February.

- Her revenue looks amazing for half the year.

- But from March to September, bookings plummet.

One year, she didn’t save enough from her busy season. By August, she was dipping into credit cards to pay rent.

How to Build a Budget for Seasonal Revenue

1. Map Out Your Seasonal Trends

Start by looking at your last 2–3 years of revenue.

Plot it month by month. You’ll often see clear patterns:

- Festivals or holidays driving sales

- Slow months after peak seasons

- Weather changes impacting demand

Knowing your peaks and valleys is half the battle.

2. Budget Revenue Monthly—Not Annually

Many businesses just divide annual revenue by 12. Don’t do that if you’re seasonal!

Instead, forecast each month separately. For Raj’s ice cream shop:

- March – June → ₹10 lakhs per month

- July – Oct → ₹5 lakhs per month

- Nov – Feb → ₹2 lakhs per month

This prevents overestimating income during slower periods.

3. Separate Fixed vs. Variable Costs

Seasonal businesses often have:

- Fixed costs (rent, insurance, salaries) → Stay the same each month.

- Variable costs (inventory, part-time staff, utilities) → Rise and fall with sales.

Knowing which costs stay constant helps you plan cash needs in lean months.

4. Build a Reserve Fund

During good months, set aside cash for lean months.

Ananya, the wedding photographer, now puts 30% of peak-season income into a savings account. When business slows, she draws from it instead of going into debt.

5. Plan Expenses to Match Cash Flow

Avoid major expenses during slow periods unless you’ve saved for them.

Example:

- Raj upgrades his ice cream machines in March, not November, because cash flow is strong.

How a Virtual CFO Can Help

Budgeting for seasonal businesses can feel overwhelming. A Virtual CFO can:

- Analyze your seasonal revenue patterns

- Create monthly cash flow forecasts

- Help decide how much to save during busy months

- Advise on cutting costs in lean times

- Keep you calm and confident instead of stressed and reactive

They’ll help you turn your seasonal business into a stable, sustainable operation.

Quick Tips for Seasonal Businesses

✅ Know your slow months. Don’t pretend revenue will be steady if it never is.

✅ Forecast monthly, not yearly. Seasonal swings demand a detailed approach.

✅ Save during the highs. Future-you will be thankful during the lows.

✅ Consider multiple revenue streams. Explore off-season products or services.

✅ Keep updating your budget. Markets change—so should your plan.

Final Thoughts

Running a seasonal business doesn’t have to mean riding a financial rollercoaster.

With the right budget—and a proactive plan—you can smooth out the dips and make your best months truly count.

So let me ask you: Is your budget ready for your seasonal swings?

If you’re tired of the stress and surprises, maybe it’s time to bring a Virtual CFO onto your team. They’ll help you stay ahead of the curve—and keep your business strong all year long.