How to Handle Budget Variances Without Panic

Let’s face it—no matter how carefully you plan your budget, reality loves to throw a curveball.

Expenses run higher than expected. Sales fall short of your forecasts. And suddenly, the numbers aren’t matching what’s in your spreadsheet.

This is what we call a budget variance—the difference between what you planned and what actually happened.

Here’s the thing: variances are normal.

They don’t mean you’ve failed. They’re signals telling you where to look closer and make decisions. And with the right approach, you can handle them calmly, instead of spiraling into panic.

What Is a Budget Variance?

Let’s keep it simple:

- Budget variance = Actual results – Budgeted numbers

If your budget predicted ₹10 lakhs in sales, but you only brought in ₹8 lakhs, that’s a ₹2 lakh negative variance.

If you budgeted ₹3 lakhs for marketing, but spent only ₹2 lakhs, that’s a ₹1 lakh positive variance.

Real-World Examples

Let’s look at two practical scenarios:

Example 1: The Marketing Surprise

A boutique fashion brand budgeted ₹5 lakhs for Facebook ads in a quarter.

- The ads performed better than expected.

- Sales spiked—but they spent ₹7 lakhs instead of ₹5 lakhs.

Result?

- A ₹2 lakh negative variance in marketing spend—but a positive impact on revenue.

Instead of panicking, they analyzed ROI. The extra spend was worth it because profits increased overall.

Example 2: The Revenue Dip

A digital agency planned for ₹50 lakhs in revenue for the quarter.

- A key client delayed a big project.

- Revenue came in at only ₹40 lakhs—a ₹10 lakh negative variance.

Rather than panic, the owner:

- Checked cash flow reserves.

- Adjusted hiring plans.

- Focused on upselling smaller clients to bridge the gap.

How to Handle Budget Variances Calmly

1. Don’t Ignore Variances

Ignoring variances won’t make them go away.

Look at your numbers monthly (or even weekly if you’re growing fast). This keeps surprises small and manageable.

2. Analyze the Cause

Ask:

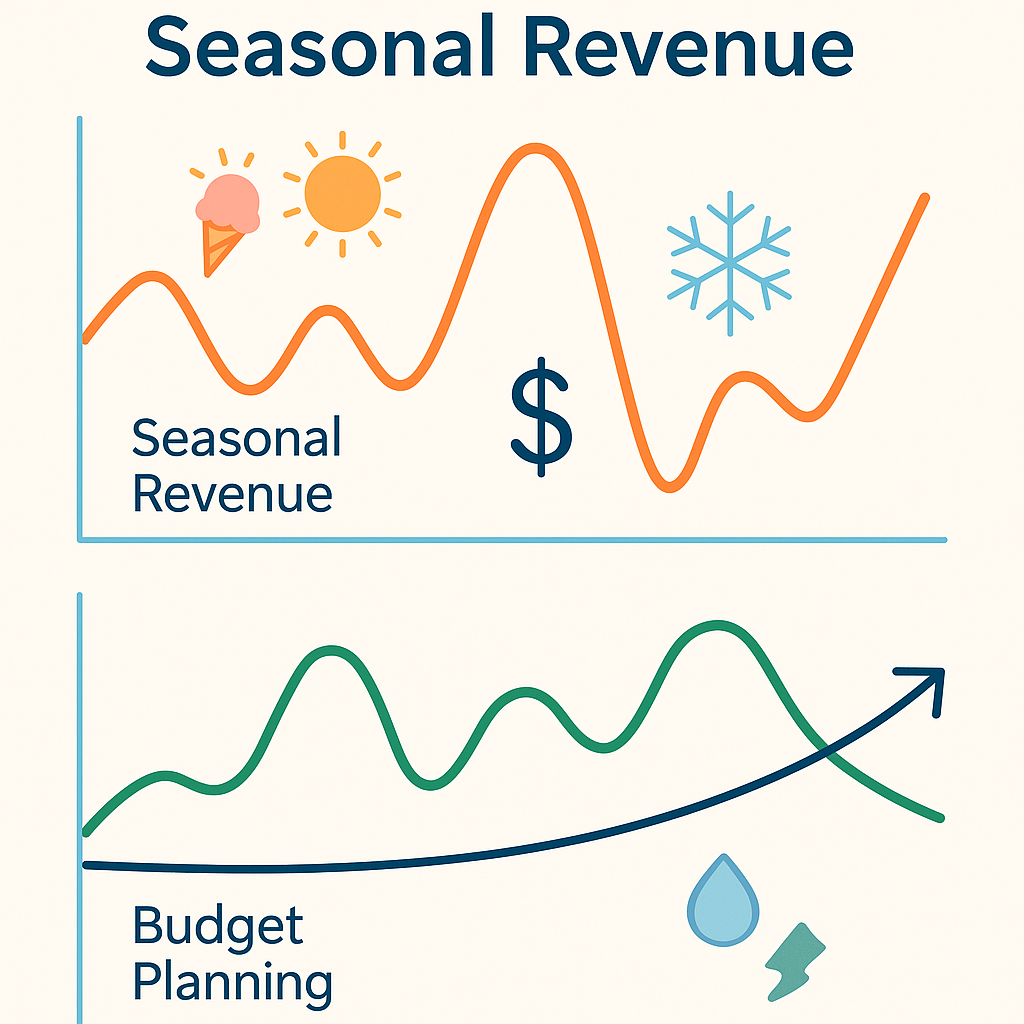

- Was this a one-time event?

- A timing issue (e.g. delayed invoices)?

- A sign of a bigger trend?

Example: Higher supply costs could be a market-wide issue requiring price adjustments.

3. Assess the Impact

Not all negative variances are bad.

- Higher marketing spend might bring higher revenue.

- Lower-than-expected costs could indicate under-investment.

Always look at the big picture.

4. Take Action

Once you know the cause:

✅ Adjust your forecast for the coming months.

✅ Cut costs where possible if cash flow is tight.

✅ Explore ways to boost revenue.

✅ Communicate with stakeholders to avoid surprises.

5. Keep Perspective

Small variances are normal. Don’t let them derail your confidence or strategy. Focus on trends, not just one month’s numbers.

Quick Tip

Set a tolerance level for variances.

For example:

“We’ll only investigate variances greater than ±10% of budget.”

This saves you from chasing minor fluctuations that don’t really matter.

How a Virtual CFO Can Help

A Virtual CFO can:

- Help spot meaningful variances quickly.

- Analyze why they’re happening.

- Guide you in making adjustments to stay on track.

- Translate numbers into decisions you can act on confidently.

They’re your financial partner for navigating uncertainty without losing sleep.

Final Thoughts

So let me ask you: Are you treating budget variances as disasters—or as data to help you make smarter choices?

Because with the right mindset (and the right help), you can handle variances calmly—and keep your business growing strong.

Curious how a Virtual CFO could help you manage your numbers without the stress? Let’s talk!