Using Scenario Planning for Cash Flow Stress Testing

Imagine your biggest client suddenly decides to pay 60 days late. Or sales drop by 30% for three months. Or an unexpected tax bill hits your bank account.

How would your business handle it?

Scenario planning helps you answer those “what ifs” before they become emergencies. Think of it like financial fire drills for your cash flow—so you’re ready, calm, and in control no matter what happens.

Let’s dig into how scenario planning works and how you can start using it to stress-test your cash flow.

What Is Scenario Planning?

Scenario planning is the practice of modeling different versions of the future to see how they’d affect your finances.

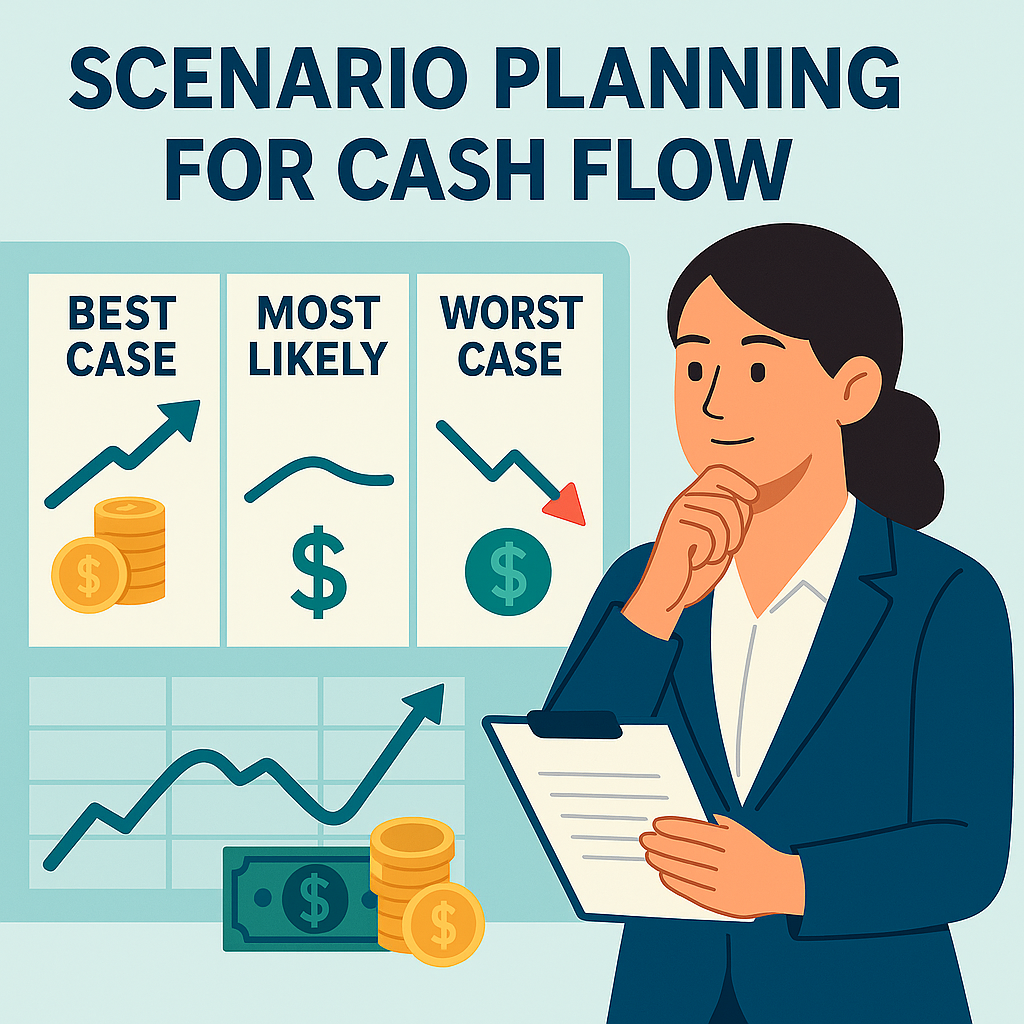

Instead of relying on a single forecast (which might be overly optimistic), you build multiple forecasts that include:

✅ Best-case scenarios

✅ Most likely scenarios

✅ Worst-case scenarios

The goal is to see how your cash flow holds up—and plan your responses in advance.

Example: The Retailer’s Summer Slowdown

Consider Nina, who owns a boutique retail shop.

Her “most likely” forecast assumes steady sales all summer. But she decides to run a scenario where foot traffic drops 25% for three months.

The result? Her cash balance dips dangerously low in August.

Because she spotted the risk early, Nina:

- Delayed a new inventory purchase

- Negotiated a temporary rent reduction with her landlord

- Launched a summer promotion to boost sales

When sales did slow down, she was ready—and avoided a cash crisis.

Why Scenario Planning Matters for Cash Flow

Here’s why this is so important:

- Cash is reality. Profits look nice on paper—but cash in the bank pays your bills.

- Business rarely goes perfectly. Clients pay late, costs go up, or sales dip unexpectedly.

- Peace of mind. You’ll sleep better knowing you have a plan for the unexpected.

How to Start Scenario Planning

You don’t need fancy software to get started—just a spreadsheet and some clear thinking.

1. Build Your “Base Case” Cash Flow Forecast

Start with your regular cash flow forecast:

- Expected cash inflows (customer payments, loans, etc.)

- Expected cash outflows (payroll, rent, vendors, etc.)

- Ending cash balance each week or month

This is your “most likely” scenario.

2. Identify Key Variables

Ask yourself:

- Which expenses could increase unexpectedly?

- What if sales drop by 10%, 20%, or 30%?

- What if clients pay slower than usual?

- What if a big expense hits unexpectedly?

3. Create Alternative Scenarios

Adjust your forecast to reflect:

- A best-case scenario (higher sales, faster payments)

- A worst-case scenario (lower sales, delayed payments, surprise costs)

For each scenario, track how your cash balance changes over time.

4. Look for Cash Shortfalls

Review your scenarios and ask:

- Do I run out of cash? If so, when?

- How deep is the cash shortfall?

- How quickly can I respond?

This tells you where the danger zones are.

5. Make a Plan

For any scary scenario, decide:

- Which costs you could cut or delay

- Whether you’d negotiate new payment terms

- If you’d need a line of credit or other financing

- Whether you’d adjust pricing or sales strategies

Another Example: The Consulting Firm

Raj runs a consulting firm. He created three forecasts:

✅ Best Case: New projects close quickly, clients pay Net 30.

✅ Most Likely: Steady sales, some clients pay Net 45.

✅ Worst Case: Two clients delay payments by 60+ days.

In the worst case, Raj discovered he’d run out of cash in Week 9.

He didn’t panic. Instead, he arranged a line of credit and updated his contracts to require partial upfront payments. The cash crisis never happened—but he was prepared.

How a Virtual CFO Can Help

Scenario planning can feel overwhelming, especially if numbers aren’t your happy place. A Virtual CFO (VCFO) can help you:

- Build tailored scenarios for your business

- Spot hidden risks in your cash flow

- Create actionable plans for each scenario

- Sleep better at night knowing you’re ready for anything

Don’t Let Surprises Sink Your Business

No one can predict the future perfectly—but scenario planning helps you prepare for it.

Instead of crossing your fingers and hoping things work out, you’ll have a clear roadmap for how to keep your business afloat—even in stormy weather.

Curious what your worst-case scenario might look like—and how to survive it? Let’s chat. It might be the smartest move you make this year.