Why Driver-Based Forecasting is the Future

In today’s rapidly evolving healthcare landscape, forecasting isn’t just about predicting the future; it’s about shaping it. Accurate, strategic forecasting can set your organization apart as it negotiates through financial challenges and operational complexities.

Summary: Driver-based forecasting empowers organizations to make informed decisions by focusing on key performance drivers, reducing inaccuracies and accelerating approval cycles, ultimately leading to better financial health.

What’s the real problem?

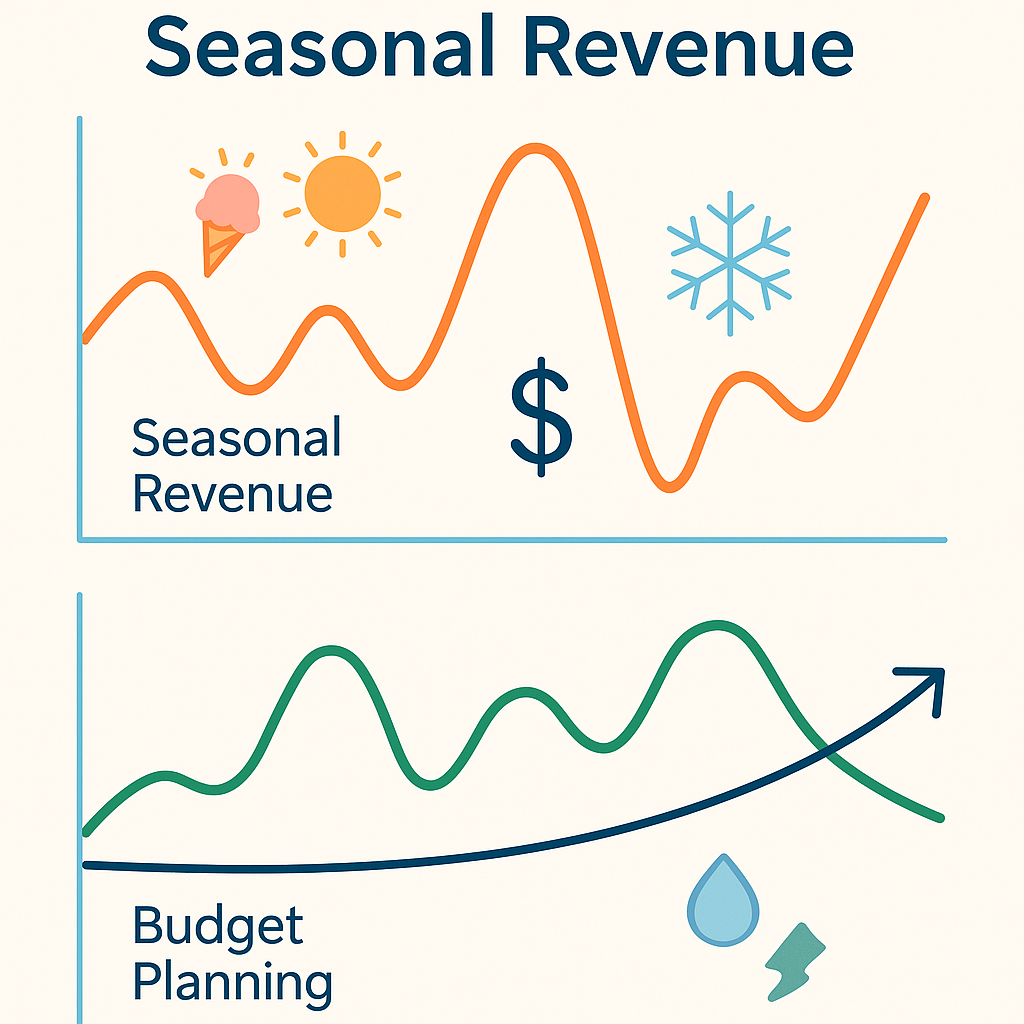

In many healthcare operations, traditional forecasting methods often fall short. They rely on historical data without factoring in real-time drivers of performance. This outdated approach can lead to missed opportunities and budget overruns.

- Frequent missed financial targets

- Lengthy approval cycles stalling critical initiatives

- Wasted resources due to inaccurate forecasts

- Inconsistent stakeholder confidence and buy-in

What leaders get wrong

Many leaders underestimate the importance of dynamic forecasting. They often believe that simple trend analysis or last year’s data is sufficient. This can lead to complacency and a reactive rather than a proactive stance. Others might skip incorporating operational drivers, focusing only on financial metrics, which ignores the bigger picture.

A better approach

Implementing driver-based forecasting can revolutionize your financial processes. Here’s a simple framework to follow:

- Identify Key Drivers: What factors influence your performance the most? For a hospital, this could be patient volume, average length of stay, or payer mix.

- Develop Real-Time Metrics: Create dashboards in tools like Power BI that reflect these drivers in real time.

- Engage Stakeholders: Include team members from finance, operations, and clinical departments to ensure buy-in and accuracy.

- Iterate Regularly: Forecasting isn’t a one-time event. Regularly update your model to reflect changes.

- Analyze Outcomes: After implementation, review the effectiveness of your forecasts and adjust your strategy.

For example, a regional healthcare provider successfully shifted to a driver-based model and reduced their forecast error rate by 20%. By focusing on drivers like patient admissions and treatment costs, they made more accurate budget projections.

Implementation checklist

- Assess your current forecasting methods

- Identify key performance drivers in your organization

- Pilot a Power BI dashboard to visualize these drivers

- Gather input from cross-functional teams

- Establish a feedback loop for continuous improvement

- Train teams on interpreting the data

- Set regular check-ins to review forecast accuracy

- Communicate changes to all stakeholders

- Explore finance automation options to streamline processes

- Document lessons learned for future iterations

What good looks like

- Improved forecast accuracy of 90% or higher

- Reduced cycle time for budget approvals

- Enhanced stakeholder engagement and confidence

- Increased ROI on strategic initiatives

- Better alignment between operations and finance

Risks & how to de-risk

- Lack of buy-in from stakeholders: Mitigate this by involving team members early in the process.

- Data quality issues: Ensure accurate, real-time data by investing in reliable data management systems.

- Overcomplicating the model: Keep it simple—focus on a few key drivers that matter most to your operations.

Tools & data

Investing in finance automation can give you the edge. Solutions like Power BI provide powerful dashboards that make leadership reporting straightforward and insightful. Leveraging these tools can transform the way you interact with financial data and operational metrics.

Next steps

Work with Finstory. If you want this done right—tailored to your operations—we’ll map the process, stand up the dashboards, and train your team. Let’s talk about your goals.

📞 Ready to take the next step?

Book a 20-min call with our experts and see how we can help your team move faster.

Prefer email or phone? Write to info@finstory.net

or call +91 44-45811170.